What is Financial Fridays?

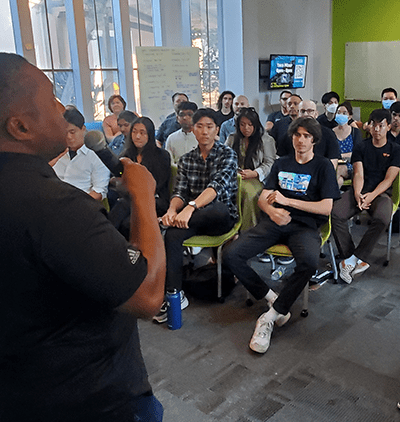

Financial Fridays is a weekly program designed to empower students with essential financial literacy skills. Each session includes interactive discussions and hands-on activities covering topics like budgeting, saving, credit management, and investing. The program aims to reduce financial stress, boost confidence, and help students make informed decisions for both short-term needs and long-term financial goals. With practical, real-world applications, Financial Fridays equips students with the tools to take control of their financial wellness and build a more secure future.

Financial Fridays: Empower Your Financial Future

History and Inspiration

Financial Fridays were created by Ruby Mejia, the Unit Business Coordinator at the ANTrepreneur Center. Ruby’s experiences with various entrepreneurial programs and her passion for financial literacy inspired her to develop these workshops.

Workshop Structure and Content

Our workshops cover practical financial skills, including budgeting, saving, investing, and credit management. Using Intuit software, each session includes interactive discussions and hands-on activities to ensure you gain practical experience with financial concepts.

Value for Students

Whether you plan to start your own business or thrive within an existing company, these workshops provide the knowledge to make informed financial decisions and build a strong financial foundation.

Financial Friday Workshops and Office Hours Every Friday from 1:00-2:00 pm

Why Financial Literacy

Understanding financial literacy is crucial for you as a college student because it lays the foundation for future financial stability and success. In college, you often juggle multiple responsibilities, including managing tuition, living expenses, and part-time jobs. Without proper financial knowledge, it’s easy to fall into debt, miss out on saving opportunities, or mismanage funds. Learning about budgeting, saving, investing, and credit management empowers you to make informed decisions, avoid common financial pitfalls, and set yourself up for long-term success. Whether you plan to start your own business or aim to excel in a corporate role, mastering financial literacy equips you with the skills to navigate the financial challenges of both personal and professional life effectively.

Financial Fridays: Empower Your Financial Future

Stop by the ANTrepreneur Center for our Financial Friday workshops and office hours.

We invite finance professionals and UC Irvine alumni to share their knowledge and experiences during office hours

Equip yourself with the knowledge to navigate financial challenges and achieve success in any path you choose!

Latest News From the ANTrepreneur Center

Inside Demo Day: What 300+ Startup Pitches Taught Us

More than 300 pitch conversations. Over 50 judges. One Demo Day designed for learning, not verdicts. This article shares the most common themes from judge feedback at the UC Irvine ANTrepreneur Center’s AI Innovation Course Demo Day to help early-stage founders learn faster and pitch with greater clarity.

Interview with ANTrepreneurs: Alen Yaco of ROID AI

In this interview, UC Irvine student entrepreneur Alen Yaco shares the story behind ROID AI, a fitness-focused social network powered by artificial intelligence. From teaching himself how to code and overcoming repeated App Store rejections to building an evidence-based health platform that helps users, trainers, and coaches connect in one place, Alen reflects on persistence, accountability, and the realities of launching a startup as a solo founder while still in college.

Turning Your Idea Into Something Real: Lessons From Y Combinator (Part 2 of 3)

Turning an idea into something real requires action, not perfection. Drawing from Y Combinator lessons, this article explores why fast execution, early user feedback, and rapid iteration matter more than planning, and how students can use UC Irvine resources to build momentum and learn what truly works.